Snooze Payment

Product Design

Snooze function is a product that allows users to delay their payments for a predetermined amount of time. It aims to provide users with greater flexibility and control over their finances, enabling them to better manage their cash flow.

TYPE:

Product Design

ROLE:

Product Designer

Client:

EQL Finance

Year:

2022

About the Project

Context

The purpose of the snooze feature was to notify users that their payment is due soon, but they currently lack the funds to cover it. By allowing them to “snooze” the payment like an alarm for a later date, the feature provides users with greater flexibility and control over their finances.

User Problem

Users may not be able to pay the loan on time, but they are concerned about incurring additional charges such as interest fees or overdraft fees if they pay late.

Role

Product Designer

Led the EQL team in the design of the snooze functionality for the app.

Responsibilities

Conducting interviews, wireframes, usability testing with users, design iterations, prototyping and developer hand off.

Target Users

This function is primarily aimed at individuals who experience periodic cash flow issues and need a more adaptable payment alternative.

Insights

Many loan users are aware of the payment schedule but face difficulty in meeting their repayment obligations, leading to frequent support requests for extensions or a later payment date.

2. Incorporating a feature that allows users to request a late payment date can help to reduce the volume of similar support requests and provide a more user-friendly experience for borrowers to manage their repayment more effectively.

Ideating

This idea was inspired by the common experience of being prompted to update software on our devices, but continually delaying or snoozing the reminder. Similarly, we often receive reminders or notifications that we intend to address later, but end up dismissing or ignoring altogether.

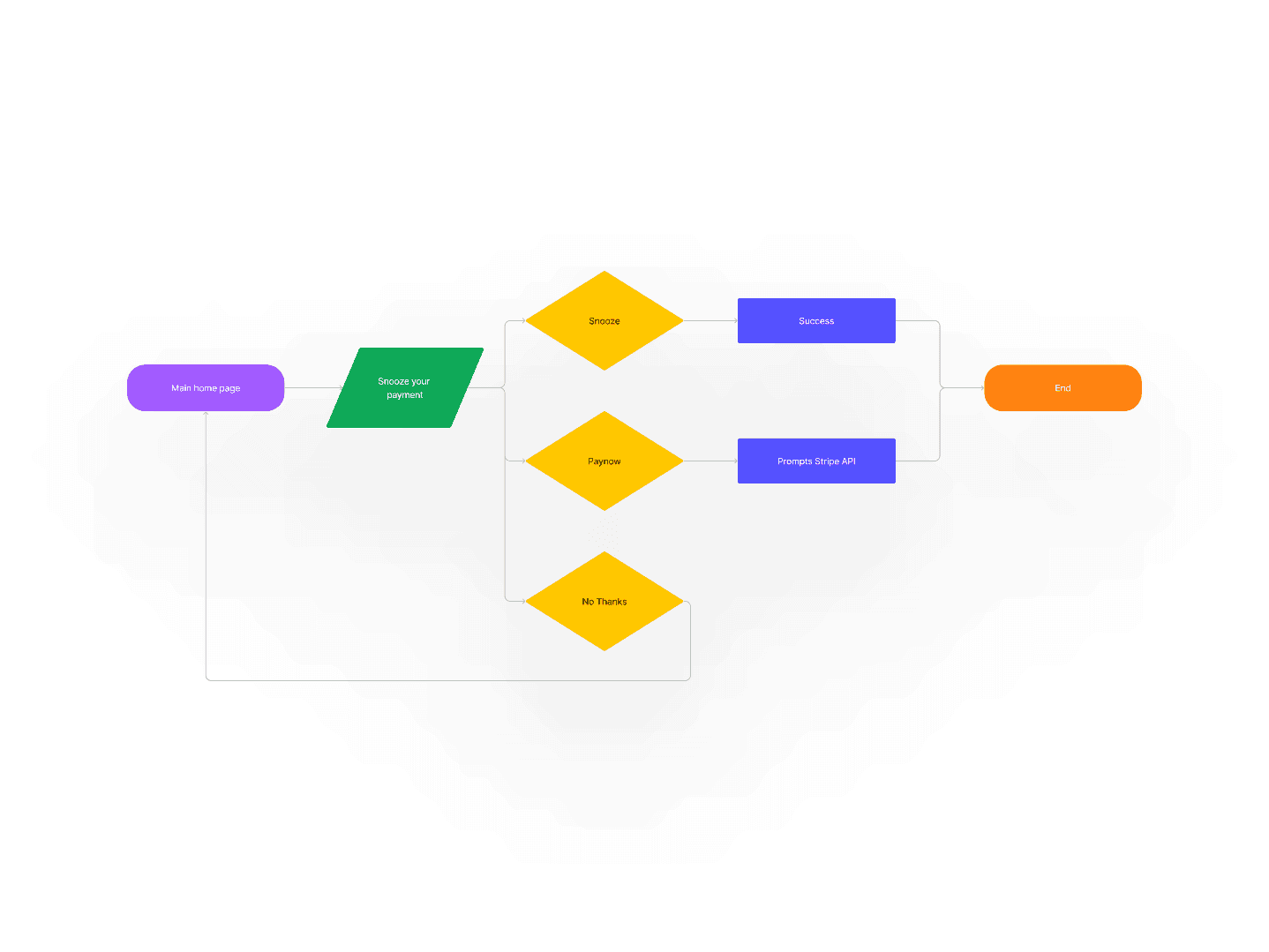

Userflow

Mid Fidelity

Usability Testing

To assess the usability of this function, we carefully selected users from our MVP Group on social media. We then provided them with prompts and guided them through the designs, actively listening to their feedback and incorporating their insights into the development process.

Conducted usability testing with participants over Zoom, each lasting about 30 minutes.

Objective of the Test:

Observe if users can accomplish the specified task

Determine if users can recover from any mistakes made during the task

On top of that created revisions based on the feedback provided to fill the gap between my understanding of the users and what the users experienced.

High Fidelity Wireframes

Key Takeaways

Positive Takeaways

User feedback indicates that the idea of providing loan payment alerts was well-received, as it addresses a common issue of users forgetting about their repayment obligations.

2. Users appreciated the option to push back loan payments when funds were tight, indicating that this feature provided greater flexibility and helped them manage their budgets more effectively.

Other Takeaways

For users who consistently pay on time and do not experience issues with repayment, these alerts may be an unnecessary bother.

2. Choosing to snooze the payment further could result in a longer subscription period and ultimately lead to additional charges.

Final Solutions

The final solution for this feature is intended only for users who struggle with making timely payments, and is not a mandatory feature for all users. Those who consistently make on-time payments and do not experience these issues will not be affected by this feature.

Data

We measured the success rate of this feature using MetaBase, a powerful analytics tool that allowed us to track user engagement and adoption. Our analysis revealed that 32% of our users are currently utilizing the feature, indicating moderate adoption.

While the adoption rate may not be as high as we had hoped, user feedback has indicated that for those who have used the feature, it has been extremely helpful in managing their loan payments more effectively. Users have expressed appreciation for the alerts and notifications, which have helped them stay on top of their payment schedules and avoid late fees or other penalties.

We have also observed that users who initially did not use the feature have started to engage with it more frequently after receiving follow-up reminders and prompts. This suggests that ongoing outreach and education may help boost adoption over time.

Next Steps

Based on these findings, we believe that the feature has the potential to be a valuable asset for users who struggle with timely loan repayment. Going forward, we plan to continue monitoring user engagement and soliciting feedback in order to further refine and improve the feature. Ultimately, our goal is to provide our users with the most intuitive and effective loan management tools possible, and we believe that this feature is an important step towards achieving that objective.

References — Chaeyoung Park, Nestor Koylyak, Paul Pierre, Eddie De Guia

Checkout the live product — www.eqlfinance.com