About

Introducing the Equal Finance Cash Advance Solution Redesign, a transformative initiative aimed at improving access to short-term funds through a user-first approach. This project tackled the dual challenges of high-interest fees and a complex user interface that previously hindered adoption and conversion rates. As the lead product designer, I spearheaded efforts to reimagine the experience, ensuring it was intuitive, secure, and empowering for users.

Client

EQL Finance

Category

Product Design

,

Finance

Year

2022

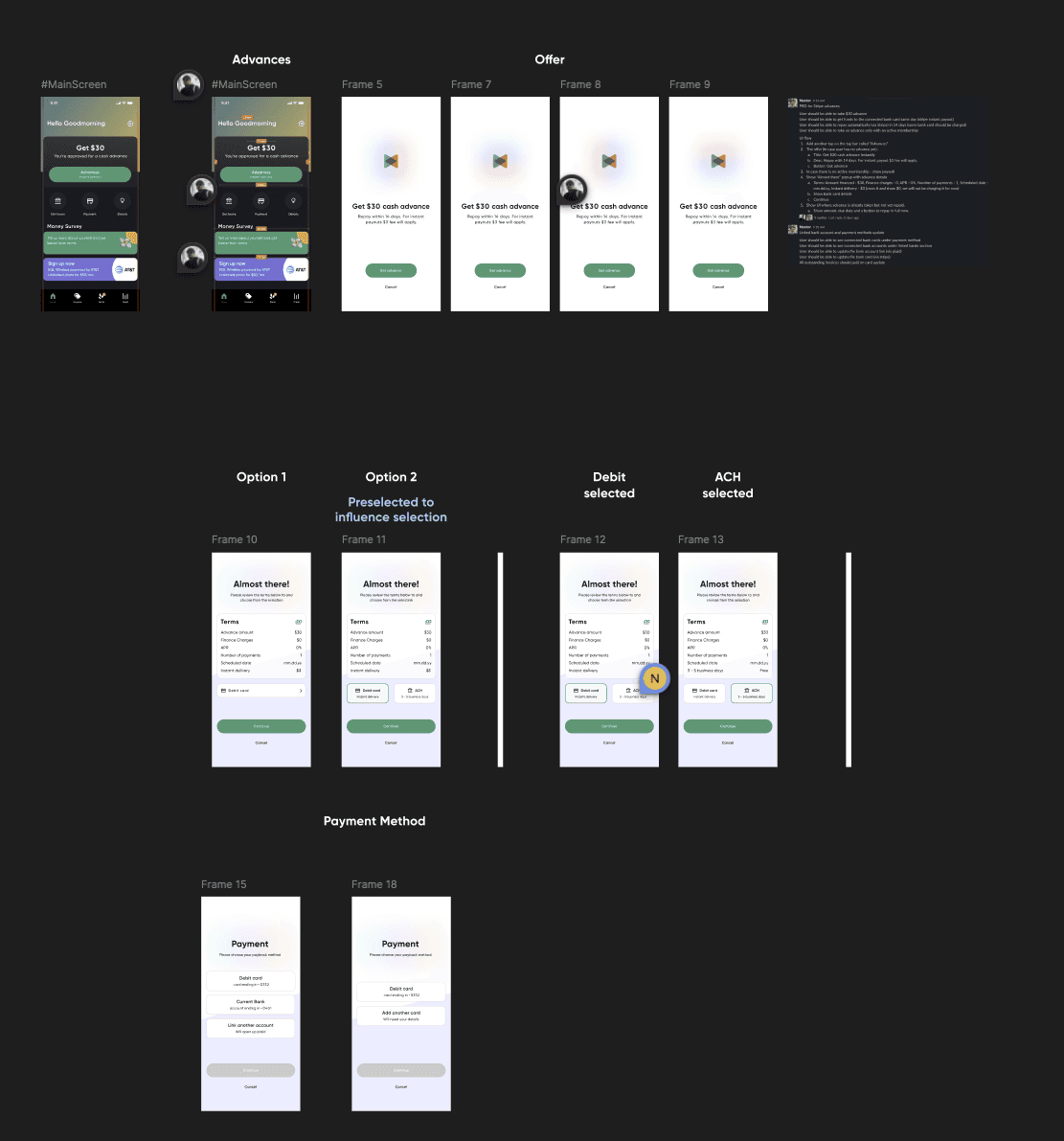

The redesign began with extensive user research, including competitor analysis and interviews, to uncover the motivations and pain points of individuals seeking cash advance services. Insights revealed that users were deterred by opaque interest fees and a cumbersome process, which often left them frustrated and disengaged. Armed with these findings, the team brainstormed innovative solutions to create a system that was not only efficient but also transparent. Key improvements included the introduction of an informative onboarding flow to build user trust, the integration of the Plaid API for secure and streamlined account verification, and flexible disbursement options to suit varied financial needs. These features were designed to minimize friction, enhance clarity, and empower users to make informed financial decisions. The project also involved iterative prototyping and usability testing with real users, ensuring the designs addressed their challenges effectively. Mid-fidelity wireframes were tested via Zoom sessions to observe task completion, gather feedback, and refine the experience further. By focusing on user needs and delivering a thoughtful, research-driven redesign, this project successfully transformed the cash advance process into a reliable, accessible, and user-centric solution, promoting financial well-being and confidence for all Equal Finance users.

The Equal Finance Cash Advance Solution Redesign marked a pivotal step in enhancing access to financial tools that empower users to manage their short-term needs with confidence and ease. By focusing on the user experience, transparency, and usability, the project achieved significant improvements in both functionality and engagement. Post-launch metrics validated the success of the redesign, showcasing a 45% increase in user sign-ups, a 60% boost in conversion rates for cash advance requests, and a 30% reduction in user drop-offs during the onboarding process. Additionally, user satisfaction scores improved by 25%, with users praising the simplicity of the process and the clarity provided by the new onboarding and repayment features. Beyond the numbers, this project demonstrated the power of research-driven design in addressing real user pain points. By streamlining processes and building trust through transparency and security, we enabled users to access funds more confidently while fostering loyalty to Equal Finance as a trusted financial partner. This redesign is not only a testament to the impact of thoughtful, user-centric design but also a reflection of how collaborative efforts can lead to meaningful innovation. It reinforces the importance of understanding and addressing user needs, resulting in a product that truly makes a difference in people’s financial lives.